After its outstanding sales estimate, Nvidia Corp (NVDA.O) rose 26% on Thursday, moving closer to a $1 trillion market valuation. However, Wall Street has yet to price in A.I.’s game-changing potential.

The stock’s more than two-fold jump this year put Nvidia on track for a U.S. company’s greatest single-day value gain.

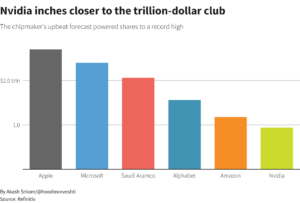

Nvidia is double the size of TSMC (2330. T.W.), Taiwan’s second-largest chipmaker. It trails only the trillion-dollar businesses Apple Inc (AAPL.O), Alphabet Inc (GOOGL.O), Microsoft Corp (MSFT.O), and Amazon.com Inc (AMZN.O) in the U.S.

Stock markets from Japan to Europe rallied on-chip and AI-focused corporate earnings. Big Tech businesses other than Amazon increased 0.7% to 3.5% in the U.S., while AMD.O rose 10%.

Stock markets from Japan to Europe rallied on-chip and AI-focused corporate earnings. Big Tech businesses other than Amazon increased 0.7% to 3.5% in the U.S., while AMD.O rose 10%.

As Nvidia dominates the chip market for powering ChatGPT and other A.I. services, 27 analysts raised their price targets on the stock.

The average price goal has increased this year. Elazar Advisors’ $644.80 price estimate puts Nvidia’s valuation at $1.59 trillion, comparable to Alphabet’s.

“In the 15+ years we have been doing this job, we have never seen a guide like the one Nvidia just put up with the second-quarter outlook that was by all accounts cosmological, and which annihilated expectations,” Bernstein analyst Stacy Rasgon said.

On Wednesday, Nvidia, the fifth-most valuable U.S. firm, forecasted quarterly sales over 50% above the average Wall Street estimate. It said it would have extra A.I. chips in the second half to fulfill demand.

As generative A.I. is applied to every product and service, CEO Jensen Huang stated $1 trillion worth of data center equipment must be replaced with A.I. chips.

Big Tech corporations have turned to A.I. to boost demand for digital advertising and cloud computing, their profit engines, in a poor economy.

Analysts said Nvidia’s results suggest the generative A.I. surge could be the next significant growth driver.

We’re only witnessing the iceberg. “This could be another technological inflection point, like the internal combustion engine or the internet,” said Derren Nathan, head of stock analysis at Hargreaves Lansdown.