How Visa’s Acquisition of Pismo Drives Fintech Innovation in Latin America

Introduction

In the rapidly evolving landscape of fintech, strategic acquisitions are pivotal in shaping the industry’s future. One recent significant deal that has captured the attention of the financial and technology sectors is Visa’s acquisition of Pismo, a prominent Brazilian fintech company. This article delves into the details of this game-changing acquisition and highlights its implications for fintech innovation in Latin America.

The Visa-Pismo Acquisition: A Win-Win for Both Parties

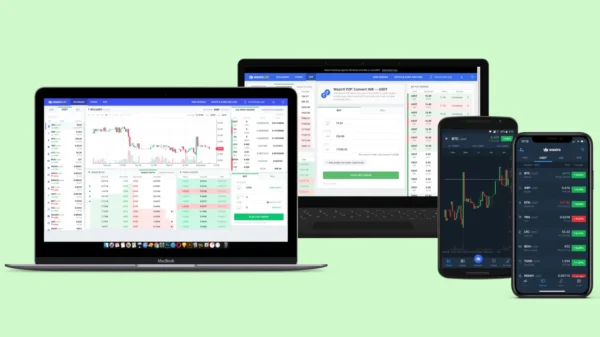

Visa’s acquisition of Pismo for $1 billion marks a milestone in the fintech space, particularly in Latin America. This deal positions Visa as a key player in the region, strengthening its market presence and expanding its offerings to financial institutions and fintech clients. Pismo’s cloud-based platform, serving over 70 million accounts and facilitating transactions worth over $200 billion annually, adds substantial value to Visa’s ecosystem.

Fostering Fintech Innovation

With the acquisition of Pismo, Visa takes a significant step forward in fostering fintech innovation in Latin America. By integrating Pismo’s advanced cloud payment processing technology and infrastructure into its operations, Visa can enhance its service offerings and support emerging payment formats like Pix. This move solidifies Visa’s position as a leading payment solutions provider and catalyzes the growth of the region’s fintech startups and financial institutions.

Strengthening Latin America’s Fintech Ecosystem

Latin America has recently been a hotbed of fintech activity, with a surge in innovative startups and digital banking solutions. However, the region still faces challenges in terms of funding and infrastructure. Visa’s acquisition of Pismo injects new capital and expertise into the Latin American fintech ecosystem, addressing these challenges and fostering a more robust and competitive landscape.

Leveraging Pismo’s Expertise

Pismo brings expertise and experience in cloud-based payment processing and infrastructure. Its platform is utilized by major financial institutions like Itaú and BTG and fintech companies like N26. By leveraging Pismo’s capabilities, Visa can further optimize its operations, streamline payment processes, and provide enhanced services to its vast network of clients.

Expansion into New Markets

Visa’s acquisition of Pismo solidifies its presence in Brazil and opens doors to expand into other Latin American markets. With Pismo’s established client base and infrastructure, Visa can unlock new growth opportunities and become a key player in the region’s evolving fintech landscape.

Implications for Venture Capital and Startups

The acquisition of Pismo by Visa creates exit opportunities for venture capital funds that have invested in the Brazilian fintech company, such as SoftBank and Accel. This generates positive returns for these funds and instills confidence in the Latin American fintech ecosystem, attracting further investment and fueling the growth of startups in the region.

Conclusion

Visa’s acquisition of Pismo marks a transformative moment in the fintech landscape of Latin America. By combining Visa’s global network and expertise with Pismo’s advanced cloud-based platform and infrastructure, this deal paves the way for accelerated innovation and growth in the region’s fintech ecosystem. As Visa strengthens its foothold in Latin America, it is poised to shape the future of payments and drive fintech advancements that benefit consumers and businesses alike.