The fintech company EduFi has completed a pre-seed funding round worth $6.1 million. Palm Drive Capital, Deem Ventures, Q Business, and angel investors all participated in the round that Zayn VC led. EduFi makes it possible for struggling students to obtain loans for their education.

Pakistan is a country that does not have student loan products as a category; instead, users take out personal loans with high interest and a lengthy process, according to Aleena Nadeem, founder and CEO of EduFi, who spoke with TechCrunch. The Singapore-based startup has launched an artificial intelligence-powered study now, pay later (SNPL) lending platform and its mobile app in Pakistan.

Through its financial technology platform, EduFi intends to tackle the nation’s two most pressing problems: high poverty and low literacy rates. Because of the subpar quality of public schools, over forty percent of Pakistan’s student population is enrolled in private schools; as a result, the country spends more than fourteen billion dollars annually on their education. In addition, more than half of the adult population in Pakistan does not have access to financial services such as bank accounts or insurance policies, which is a significant problem.

While working in Pakistan for the Progressive Education Network (PEN), Nadeem, a graduate of MIT who has also held positions at Goldman Sachs and Ventura Capital, saw firsthand the struggles many youngsters face while attempting to overcome financial barriers to obtain an excellent education. PEN is a charitable organization that provides free education of a high standard to children whose families cannot afford it.

Nadeem states, “Many children in Pakistan can complete their secondary education, but the percentage of students who go on to earn a higher degree at a college or university is significantly lower.” “This drop is where EduFi is trying to inject capital to bridge the gap between high school graduation and admission to first-year university programs.”

The firm, which has only been around for two years, has already formed relationships with 15 different institutions, which has made it possible for the app to be made available to about 200,000 students in Pakistan who are responsible for paying their tuition fees for undergraduate, graduate, and doctoral programs.

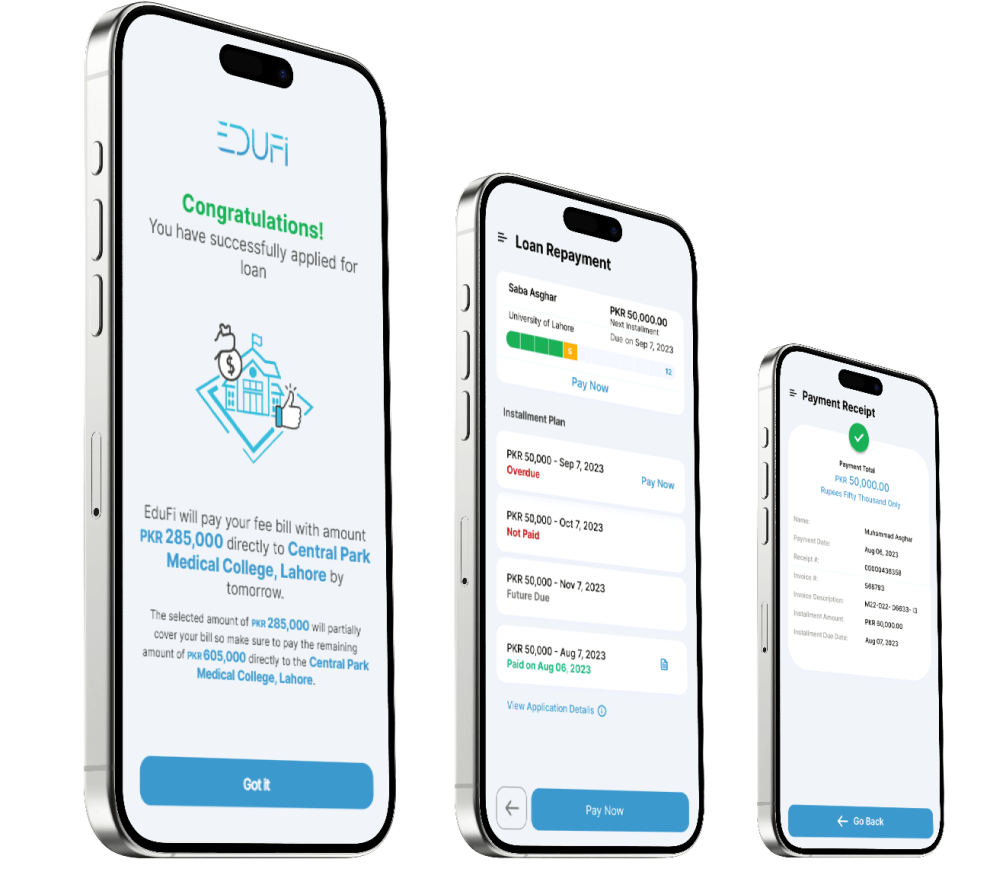

When a student or a parent applies for a loan using the EduFi app, the applicant’s (student’s or parent’s) current financial position is required. For instance, the borrower’s most recent twelve months’ worth of bank statements or a source of income supporting the borrower’s ability to repay loans, such as salaried employment, a small business, or freelancing work, are acceptable documentation. After EduFi approves the student loan facility, the money is sent immediately to the bank of the educational institution.

EduFi put its credit model to the test during its beta phase, which lasted for the previous 18 months and consisted of testing the model against the 80,000 consumer financing loans that banks had made.

The new company says that its credit rating method makes it possible to quickly disburse student loans within 48 hours of applying for them and for the loans to be paid promptly. EduFi is now awaiting the granting of its loan-making license from the Securities and Exchange Commission of Pakistan (SECP), which it has already gotten clearance to apply for. The granting of the license is anticipated to take place in November. Nadeem has stated that it evaluates its products and services with prospective consumers while collecting feedback and data to enhance its service.

It takes at least three to four weeks to get approved for a loan from a typical bank, which charges high interest rates, has a lengthy application procedure, and considers all of these factors. The firm claims that it has revolutionized the standard bank method. Customers can adapt to the loan terms and conditions and enjoy a straightforward and uncomplicated strategy, thanks to EduFi’s digital lending software.

“Education gives people hope and has the power to transform their lives.” I am only one example of the millions that are already available. Nadeem states, “EduFi offers this hope and will be a catalyst for change in people’s lives as we lift one of the greatest burdens on aspiring families.” “For instance, first-year dentistry or medical institution students must make an upfront payment of at least $8,000, which is unaffordable for many people in Pakistan. Every student that we have assisted is a demonstration of the aspiration, opportunity, and empowerment that we strive for at EduFi.

The firm will use the pre-seed funding to broaden its client base, enhance its existing platform, enter other nations in the region, and initiate the production of additional fintech goods, such as student credit cards.

“This is a significant step towards achieving financial inclusion for families with middle- and low-income families.” Because of the constraints of inflation, Pakistani families must spend more than half of their income on their children’s education, which is becoming increasingly difficult. According to Faisal Aftab, general partner at Zayn VC and creator of the company, in a statement, he claimed that the creative approach that EduFi takes would assist in reducing this burden and enable families to invest in their children’s future.