AI in Finance: Transforming the Industry

AI is revolutionizing the finance industry by offering greater efficiency, accuracy, and precision. Learn how AI is transforming the financial services sector and what it means for the future.

KEY TAKEAWAYS

- AI is revolutionizing the finance industry by improving customer service, creating more efficient processes, and increasing accuracy in data analysis.

- AI can detect fraud, reduce risk, forecast accurately, and spot market trends.

- AI can automate processes and reduce costs.

- AI is becoming increasingly important for financial institutions to remain competitive.

Do you want to know how artificial intelligence (AI) is transforming the finance industry? You’re not alone. In recent years, AI has had a profound effect on both how finance companies operate and the services they offer. From predictive analytics and automated trading to faster customer service and more accurate credit scoring, AI is driving rapid change in finance. But how exactly is AI transforming the industry? In this article, we’ll look at the impact of AI technology on the finance sector and how it’s shaping the future of the industry. So, come with us as we explore the world of AI and finance, and discover how AI is transforming the industry.

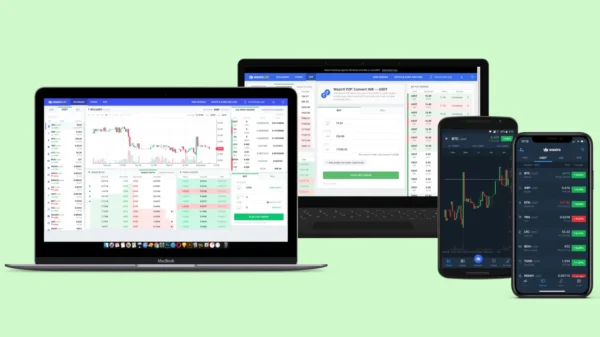

Current AI Applications in Finance

Overview of AI Applications in Finance

AI is being used across various functions in the finance industry, including customer service, fraud detection, financial planning, and loan origination. One of the main advantages of AI is its ability to analyze vast amounts of data and provide insights quickly. This has made it a valuable tool in areas such as risk management and investment decisions.

AI-driven Customer Service

AI-driven customer service is becoming increasingly popular in the finance industry. Chatbots powered by AI can answer customer queries quickly and efficiently, providing 24/7 service. AI-powered customer service also allows financial institutions to personalize their services, providing customers with more relevant information.

AI-assisted Financial Planning

AI is also being used to assist with financial planning. By analyzing a customer’s financial data, AI-powered tools can provide personalized recommendations for investment strategies, retirement planning, and debt management. This helps financial institutions to offer more personalized services to their customers.

AI-based Fraud Detection

AI is a valuable tool for detecting fraud in the finance industry. It can analyze large amounts of data to identify suspicious transactions quickly. This helps financial institutions to detect and prevent fraud before it becomes a significant issue.

AI-powered Loan Origination

AI is also being used to streamline the loan origination process. By automating the process, financial institutions can reduce the time it takes to approve a loan and provide customers with a more seamless experience. AI-powered loan origination also helps financial institutions to make more accurate lending decisions by analyzing data quickly.

Benefits of AI in Finance

As technology advances, industries across the board are being transformed by the power of AI. The finance industry, in particular, has seen immense changes and benefits from the integration of AI technology. In this article, we will explore the various benefits of AI in finance and how it is transforming the industry.

Improved Customer Experience

AI has the potential to revolutionize the way customers interact with financial institutions. With the help of AI-powered chatbots, customers can receive instant answers to their questions and concerns. This creates a seamless and convenient experience for the customer, which is essential for building brand loyalty. Additionally, AI algorithms can analyze customer behavior and preferences to provide personalized recommendations and offers. This level of personalization creates a more satisfying and engaging experience for the customer, ultimately leading to increased customer loyalty.

Increased Efficiency and Cost Savings

One of the most significant benefits of AI in finance is its ability to increase efficiency and save costs. AI-powered algorithms can automate tasks such as data entry, transaction monitoring, and fraud detection, freeing up employees to focus on more complex tasks. This not only saves time but also reduces the risk of errors and increases accuracy. By automating these tasks, financial institutions can also save money on labor costs.

Enhanced Customer Insights

By analyzing customer data, AI algorithms can provide insights into customer behavior, preferences, and spending habits. This information can help financial institutions develop targeted marketing campaigns and personalized offers, leading to increased customer engagement and loyalty. Additionally, AI can help identify and analyze patterns in customer behavior, allowing institutions to make data-driven decisions and improve their overall business strategy.

Increased Security and Fraud Prevention

AI-powered security measures can provide a higher level of protection against fraud and cyber-attacks. By analyzing patterns in transaction data, AI algorithms can detect and prevent fraudulent activities before they occur. Additionally, AI can provide real-time alerts and notifications when suspicious activity is detected, allowing financial institutions to take immediate action.

Improved Risk Management

AI algorithms can analyze vast amounts of data to identify and manage risks in real-time. This allows financial institutions to make data-driven decisions that reduce the risk of financial losses. AI can also help institutions comply with regulatory requirements by identifying potential risks and providing recommendations for compliance.

Overall, the integration of AI in finance has brought about significant benefits. For instance, improved customer experience, increased efficiency, and cost savings, enhanced customer insights, increased security, and fraud prevention, and improved risk management. As AI technology continues to evolve, it is clear that it will continue to play a vital role in the transformation of the finance industry. Financial institutions that embrace AI will undoubtedly reap the benefits of this transformative technology.

Challenges of Implementing AI in Finance

AI (Artificial Intelligence) is a breakthrough technology that has been revolutionizing the finance industry, transforming traditional banking and investment practices. But the implementation of AI in finance also has its challenges. In this article, we will explore the four most common hurdles in integrating AI into the financial sector: the high cost of implementation, lack of expertise in AI technology, regulatory concerns, and data privacy and security issues.

High Cost of Implementation

The implementation of AI in the finance sector requires a high amount of capital investment. Companies must invest in data analysis and machine learning technologies, as well as the development of custom applications and software. This cost can be too high for smaller companies, making it difficult to enter the market and compete with larger firms.

Lack of Expertise in AI Technology

AI technology is a complex field, requiring a deep understanding of programming, computer science, and machine learning. Companies must hire highly skilled experts with the knowledge and experience to develop and manage AI-driven systems. The lack of experts in the market can make it difficult for companies to find the right personnel to implement AI in their financial operations.

Regulatory Concerns

The financial industry is heavily regulated, with strict laws and regulations governing the use of AI. Companies must ensure their AI-driven systems comply with all relevant regulations or risk facing legal and financial penalties. This can be a difficult and time-consuming process, making it difficult to implement AI promptly.

Data Privacy and Security Issues

The use of AI in finance also raises data privacy and security concerns. AI systems rely on large amounts of data to function, and companies must ensure the data is collected, stored, and used securely. If the data is not properly secured, it can be exposed to malicious actors, leading to financial losses and reputational damage.

Ultimately, AI is a powerful technology that can revolutionize the finance industry. However, companies must be aware of the challenges of implementing AI. High costs, lack of expertise, regulatory concerns, and data privacy and security issues are all potential hurdles that companies must address to successfully integrate AI into their financial operations. With the right strategies and investments, these challenges can be overcome, allowing companies to reap the benefits of AI in finance.

Final Thoughts

As you can see, AI is transforming the finance industry in many ways. The benefits of AI in finance are numerous, and they are making a significant impact on the industry. By implementing AI, financial institutions can improve their customer experience, increase efficiency and cost savings, enhance customer insights, increase security and fraud prevention, and improve risk management.

In today’s fast-paced financial world, AI is providing a competitive edge to those who embrace it. With its ability to analyze vast amounts of data quickly, AI is helping institutions make informed decisions and manage risk more effectively. It is also enabling them to deliver personalized recommendations, which are helping customers achieve their financial goals more easily.

Overall, the transformational impact of AI in finance cannot be overstated. It is changing the way financial institutions operate and interact with their customers. In an evolving industry, AI will play a vital role in shaping its future. Therefore, those in the finance industry should stay up-to-date with the latest AI trends and developments. If you are to remain competitive in the market, being in the know is a must.