According to someone who knows the situation, CRED is discussing purchasing Kuvera, a firm that runs an online wealth management platform. This development demonstrates the Indian fintech giant’s expanding interest in the lucrative mutual fund industry.

The source, who requested anonymity because the specifics are secret, said that the purchase discussions are still underway and that a transaction may be finalized in weeks. CRED or Kuvera did not immediately answer an inquiry for comment.

With its zero commission offer, dependable customer support, and wide selection of investment tools, including the capacity to automatically adjust the portfolio to avoid over-reliance on a particular asset, Kuvera, founded by industry veterans seven years ago, has attracted many wealthy customers in India.

According to someone familiar with the situation, Kuvera, which has raised approximately $10 million and collaborated with other companies, including Amazon, has an AUM of roughly $1.4 billion.

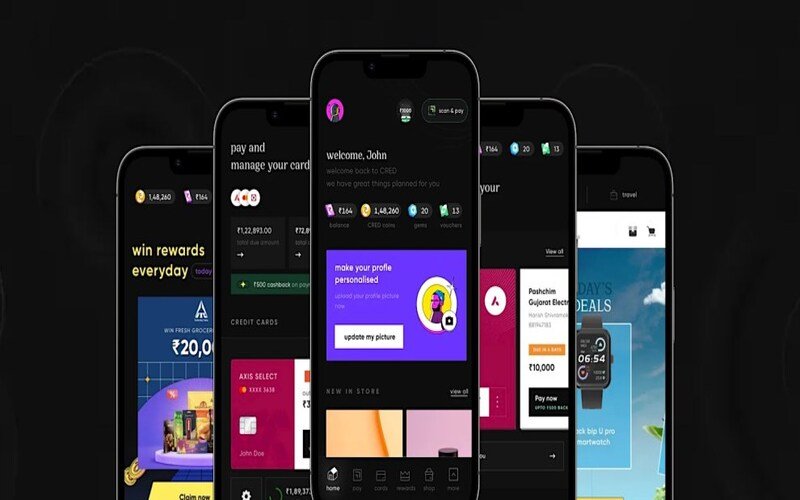

The Indian financial behemoth Kuvera, which caters to some of the wealthiest clients in the nation, is increasing its products while CRED is showing interest in the company. Five years ago, the app bearing its name first debuted with a function to assist users in making on-time credit card payments. Since then, it has grown to include e-commerce and financing and dozens of features that encourage wise financial decisions.

The firm has long considered expanding its money management options. It had discussions with Bengaluru-based Smallcase last year, but no agreement was reached. (CRED has made several investments during the last three years, buying HapPay and taking a share in LiquiLoans and CredAvenue.)

CRED, which by volume processes a third of all credit card payments in India, may find mutual funds to be a lucrative area.

One of the biggest and fastest-growing mutual fund markets worldwide is that of India. The assets under management (AUM) of the Indian mutual fund sector are currently over $575 billion, up more than 20% from a year earlier, according to the Association of Mutual Funds in India (AMFI).

The growing middle class in India is boosting the mutual fund sector’s expansion thanks to higher discretionary incomes. Rising financial literacy and the proliferation of digital applications have increased awareness, and past returns among Indian investors have bolstered their popularity.