Many startups now offer corporate credit cards. These companies offer automated expenditure management to compete with Concur and Expensify.

These startups earn interchange fees from corporate card transactions, like Ramp. Some startups sell expenditure management software subscriptions. Last year, corporate card provider Brex expanded into software.

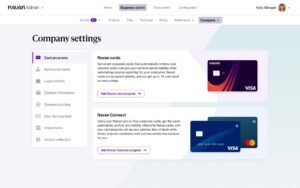

Navan (previously TripActions) offers corporate cards and software subscriptions. In a twist, the company launched Navan Connect, a patented card-link technology that allows organizations to offer automatic spending management and reconciliation without changing corporate card providers. Navan launched with Mastercard and Visa and expects to add other networks soon.

Navan is targeting a big market of organizations that want to keep working with their bank but want more sophisticated expense management options. Automating expense reports eliminates one of the employees’ least favorite tasks. Still, it also gives companies more insight into how and where employees are spending so they can cut costs and ensure company policy is applied to the card.

According to Michael Sindicich, executive vice president and general manager of Navan Expense, corporate Visa and Mastercard users can now integrate Navan’s technology to set policies and budgets and automatically reconcile and file expenses.

“When we talk to customers, some want our cards and they want our credit, but we also see – especially larger companies – some who have existing banking relationships and corporate cards who want better tools to manage their employees,” Sindicich told TechCrunch. “In the past, when going with one of the new players, including Navan, you had to take their cards. But what we’ve done allows us to connect with the Visas and Mastercards of the globe and still receive that real-time reconciliation.”

Navan seems unconcerned about its new Connect product clashing with its corporate card. Sindicich stated Navan had charged licensing and software fees for its spending and travel solutions. It charges transportation and possibly implementation costs. It also receives “some commissions” from suppliers and card swipes.

He told TechCrunch. “So, Connect would cannibalize our Navan card interchange revenue. We rebated most of that interchange to clients regardless. I don’t think Silicon Valley, or we can claim to innovate by developing a better bank to compete with larger banks. Better underwriters. They raise and manage capital well. Navan can cooperate with banks to give this holistic solution using this technology. That’s our focus.”