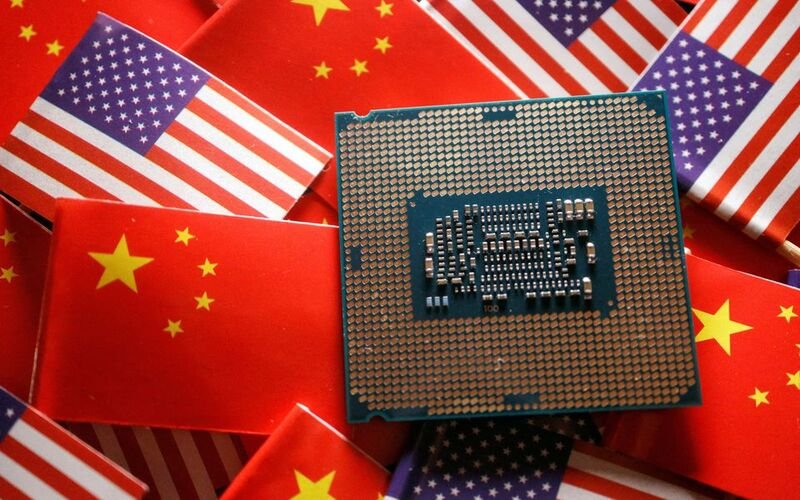

The Biden administration’s recent imposition of technology restrictions has prompted US investors to evaluate potential retaliation risks closely. As regulatory measures impact the relationship between the US and China, investors are navigating a complex landscape characterized by economic, political, and trade implications. This article delves into the significance of these tech curbs, the concerns raised by US investors, and the broader context of global economic interdependence.

A Shifting Landscape: Biden’s China Tech Curbs and Investor Perceptions

President Biden’s administration’s introduction of technology curbs has ignited a paradigm shift in US-China relations. As investors absorb the implications of these measures, a delicate balance between economic interests and geopolitical considerations comes to the forefront.

Unpacking Investor Concerns: Key Insights

1. Heightened Retaliation Risks

US investors are wary of potential retaliation from China in response to the technology curbs. The interconnectedness of global markets underscores the potential repercussions of such actions, impacting trade, investments, and economic stability.

2. Portfolio Diversification

Investors are considering portfolio diversification strategies to mitigate risks associated with heightened US-China tensions. Exploring alternative markets and assets seeks to reduce exposure to potential retaliatory measures and enhance overall portfolio resilience.

3. Evolving Diplomatic Dynamics

The tech curbs recalibrate diplomatic dynamics between the US and China. Investors are attuned to the fluidity of international relations and recognize the need to stay informed about shifting policies and their potential consequences.

Global Economic Interdependence: A Balancing Act

The concerns expressed by US investors reflect the intricate web of global economic interdependence. The ripple effects of policy decisions extend beyond national borders, underscoring the need for nuanced and well-informed strategic choices.

Conclusion: Navigating Uncertainty with Prudence

In conclusion, the aftermath of President Biden’s technology curbs has spurred US investors to exercise caution and foresight. The delicate balance between economic interests and geopolitical realities underscores the need for prudent decision-making. As investors assess potential retaliation risks and explore strategies for portfolio resilience, they contribute to a broader conversation about the intricacies of global economic interdependence and the imperative of informed, adaptive investment practices. In navigating these uncharted waters, a combination of vigilance, strategic diversification, and a clear understanding of evolving diplomatic dynamics can guide investors through the complexities of an evolving global landscape.