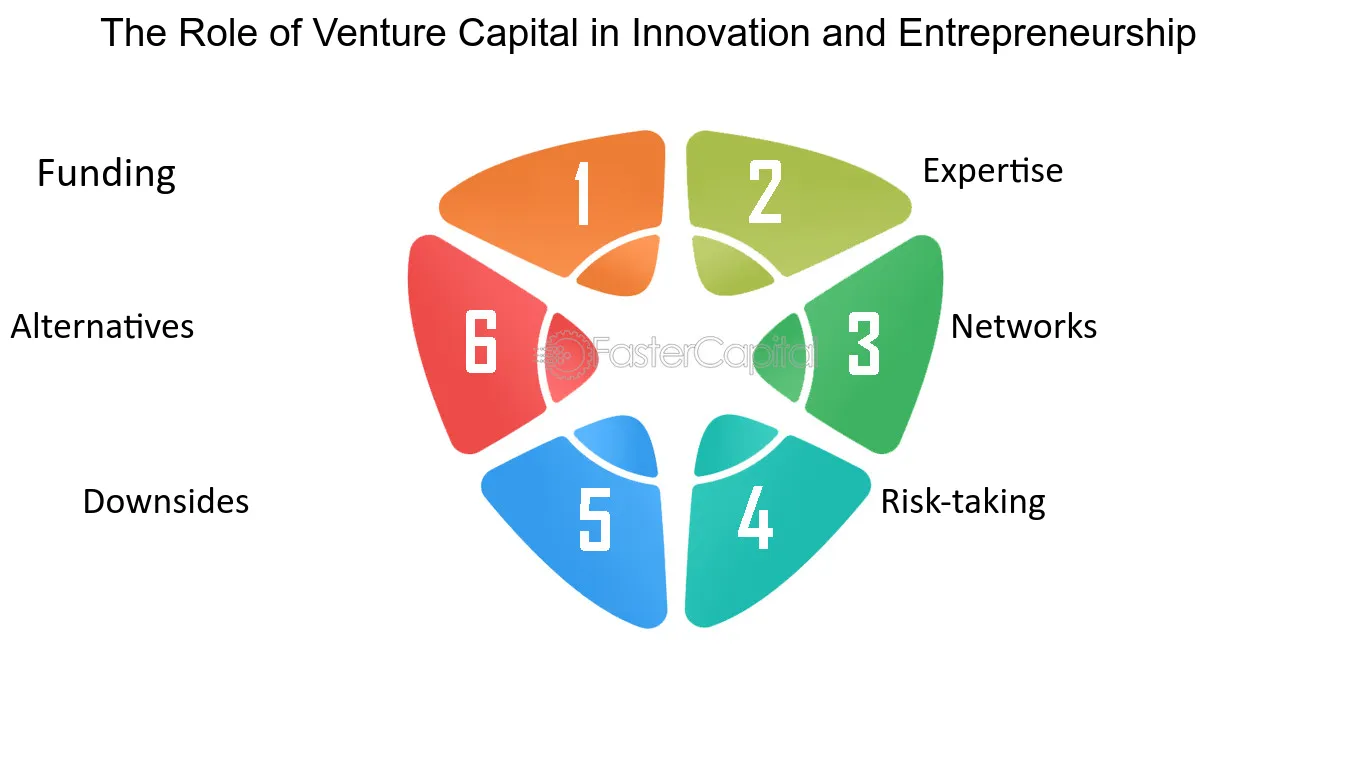

Overview

Venture Capital’s Importance within the Modern Economy

The current financial system has grown to depend closely on assignment capital (VC), which components the funding startups and early-degree businesses need to extend and innovate. Venture capitalists make investments in the capacity of ground-breaking ideas and disruptive generation, in assessment to traditional investment, which regularly concentrates on well-hooked up businesses with a single record of success. Because of its readiness to expect large dangers, assignment capital has grow to be a critical pressure at the back of monetary growth and technological advancement.

Synopsis of Technology Innovation and Its Effects

Innovation in this era is important to 21st-century development. From the creation of the net to the unfolding of artificial intelligence, technological innovation has modified entire sectors, spread out new markets, and raised living standards for billions of humans globally. It is not possible to overestimate the significance of venture capital in this context, as it gives the monetary assistance wished for bold entrepreneurs to realize their dreams. VCs make a contribution to the acceleration of innovation and the increase of the worldwide economic system by supporting modern projects.

Venture Capital’s Development

The Venture Capital Industry’s Historical Background

The choice to inspire new companies and innovations emerged inside the post-World War II generation, which is when project capital first emerged. The American Research and Development Corporation (ARDC) funded Digital Equipment Corporation (DEC) in 1957, marking one of the first venture capital investments. This signaled the beginning of a brand new monetary paradigm concentrated on excessive-danger, excessive-reward ventures into emerging technology.

Important Turning Points within the Growth of Venture Capital

Venture finance has changed plenty through the years. Some of the most famous assignment capital corporations, such as Kleiner Perkins and Sequoia Capital, were based inside the Nineteen Seventies and were instrumental within the improvement of Silicon Valley. Due in large part to the massive funding that numerous net corporations acquired for the duration of the dot-com growth of the past due Nineties, challenge capital has become increasingly vital. The project capital business grew stronger as a result of the bust that accompanied, taking a more methodical method to making an investment and studying treasured instructions.

The Connection Between Technological Developments and Venture Capital

New technologies have been developed thanks in big part to mission money. Companies which have transformed sectors were created as a result of the collectively beneficial interplay between VCs and digital marketers. For example, companies which include Apple, Google, and Facebook had been able to broaden novel products and grow quickly due to the fact they were capable of steady early assignment capital backing. With VCs usually looking for the subsequent big thing in the era, this alliance remains robust.

The Operation of Venture Capital

The Form and Procedure of Funding for Venture Capital

Investors contribute money to a fund managed by means of venture capital corporations through a based system known as project capital investment. Following that, those agencies seek for and fund promising startups, regularly acquiring an fairness component inside the commercial enterprise. The aim is to support these corporations’ growth by presenting the resources and expertise they want, with the wish of reaping massive rewards while the business in the end is going public or is bought.

Venture Capital Investment Stages

A undertaking capital investment is once in a while separated into multiple phases, every of which represents a step in the agency’s improvement:

- Seed Stage: Funding is provided in the course of this primary level for product improvement, market studies, and startup prices. There is a lot of danger associated with fairly little investments.

- Early Stage: Startups have a functioning product and a few momentum within the market at this point. Funding is applied to begin advertising and marketing, grow the personnel, and enhance the product.

- Growth Stage: Businesses in this stage are expanding into new markets, developing their operations, and generating large sales will increase. Greater sums of cash are being invested, and business growth is the primary intention.

- Late Stage: Well-hooked up, mature firms appear to raise capital so one can increase across the world, streamline operations, or be prepared for an IPO.

Important Entities in the Ecosystem of Venture Capital

Angel traders, corporate undertaking palms, institutional investors, mission capital corporations, and other individuals make up the challenge capital atmosphere. Each has a distinct function in assisting agencies by imparting funding and strategic paths. Renowned mission capital companies, together with Accel Partners, Benchmark Capital, and Andreessen Horowitz, have supported a number of the arena’s maximum wealthy organizations, making essential contributions to the generation quarter.

Venture Capital’s Effect on Tech Startups

Success Stories: Venture Capital-Transformed Businesses

Venture money is liable for the success of several IT organizations. Early-degree finance was important for agencies like Amazon, Microsoft, and Tesla as it allowed them to broaden and develop quickly. In addition to providing the required economic assets, task capital offers entrepreneurs get right of entry to know-how, training, and networking possibilities which can be vital for achievement in the cutthroat tech enterprise.

Venture Capital’s Function in Growing Tech Companies

A crucial element of assisting virtual firms grow is mission financing. Venture capitalists (VCs) facilitate groups’ investments in present day technology, staff enlargement, and marketplace growth by furnishing sizable money infusions. In order to ensure a long-term boom, this economic guide is regularly blended with strategic counseling on problems like market positioning, operational effectiveness, and scaling plans.

Case Studies: Notable Tech Startups Backed by way of Venture Capital

- Uber: The business enterprise’s short boom from a touch startup to a first-rate participant inside the transportation enterprise became enabled through substantial assignment capital investment. Uber changed into being capable of developing its platform, input new markets, and take the lead within the journey-sharing enterprise thanks to early funding.

- Airbnb: The business enterprise’s expansion became significantly aided with the aid of challenge funding, which furnished the money required to enhance the platform, establish a worldwide popularity, and recover from felony obstacles. Currently a family call, Airbnb is transforming the tourism and hospitality sectors.

- Zoom: Venture financing sped up Zoom’s transition from a specialized video conferencing application to a worldwide communication platform. Particularly throughout the COVID-19 epidemic, investments allowed Zoom to amplify its infrastructure, decorate its technology, and take a vast market percentage.

Venture Capitalists’ Role

The Qualities That Venture Capitalists See in Tech Startups

Venture capitalists examine IT corporations using some of crucial requirements, consisting of:

- Innovative Technology: project capitalists (VCs) are seeking out groups which have revolutionary eras that could upend installed markets.

- Scalable Business Model: Attracting mission funding calls for a business version that may be efficiently scaled.

- Robust Leadership Team: The founding group’s imaginative and prescient, expertise, and capacity to execute are crucial additives.

- Market Potential: Venture capitalists need agencies which have full-size sales capability and are focused on widespread, expanding markets.

- Venture Capitalists’ Impact on Business Strategy and Expansion

Venture capitalists frequently actively participate in figuring out the strategic course of the companies in their portfolio, similarly to making financial investments. They offer perceptions into competitor positioning, growth procedures, and marketplace trends. VCs use their networks to help agencies in organizing strategic alliances, obtaining critical customers, and luring pinnacle employees.

Venture Capitalists Offer Mentorship and Networking Opportunities

Mission capitalists can connect companies with a wider network of experts, potential customers, and investors, which is highly valuable. Growth can be multiplied and new opportunities can be unlocked via networking. Venture capitalists also provide mentorship, offering advice on various business development topics such as finance and product planning.

Risks and Difficulties with Venture Capital

Typical Obstacles Venture-Backed Startups Face

Venture-backed startups stumble upon numerous limitations, consisting of:

- Pressure to Scale Fast: The expectation of attaining enlargement at a fast pace can also result in fatigue and operational inefficiencies.

- Dilution of Control: Founders might also ought to supply buyers a large amount of manipulation, which may affect their capability to make choices.

- VCs have excessive expectations for the returns on their investments, that could put stress on performers to perform noticeably nicely.

Venture Capitalists’ Risks

It is always dangerous to invest in companies, and assignment capitalists run the following dangers:

- High Failure Rate: A large part of companies fail, costing buyers money.

- Market Volatility: The overall performance of portfolio firms may be impacted by way of marketplace swings and financial downturns.

- Illiquidity: Venture capital investments are typically remodeled over an extended period of time and involve capital that is devoted for a prolonged length of time.

The Power Relationship Between Investors and Entrepreneurs

The connection among enterprise owners and

traders is a precarious strength dynamic. Entrepreneurs need to control the expectancies and wishes of their assignment funders, while they provide critical sources. Finding the right balance is crucial for a successful collaboration that helps the startup grow and succeed.

Venture Capital’s Role in Tech Innovation Future

Up-and-coming Venture Capital Trends

The venture capital industry is evolving, and these new trends will significantly impact the world moving forward:

- Emphasis on Sustainability: Venture capitalists are giving precedence to investment sustainable generation and companies that adhere to strict environmental, social, and governance (ESG) standards.

- Diversity and Inclusion: To sell inclusive innovation, there’s a growing consciousness on helping various teams and underrepresented founders.

- Decentralized Finance (DeFi): As a result of the improvement of blockchain generation and decentralized finance, challenge capital funding is finding new packages in the fields of cryptocurrencies, NFTs, and blockchain groups.

- Globalization’s Effect on Venture Capital

Venture capital now has a much wider reach out of doors of conventional hotspots like Silicon Valley due to globalization.VCs are aggressively investing in emerging markets like Asia, Africa, and Latin America due to their recognition of innovation potential. A greater open and varied technique to assign capital financing is being propelled with the aid of this international attitude.

Forecasts for Venture Capital-Driven Tech Innovation within the Future

Several full-size developments are predicted to form the direction of tech innovation within the destiny, such as:

- Artificial Intelligence & Machine Learning: As these fields continue to progress, innovation will be stimulated in a number of industries, including banking and healthcare.

- Quantum Computing: By addressing complicated issues that are beyond the scope of conventional computers, the advancement of quantum computing technology has the potential to completely transform a number of sectors.

- Space Technology: It is anticipated that investments in satellite communications, space exploration, and commercial space flight would increase, creating new avenues for technological advancement.

Concluding Remarks on the Prospects of Technology and Venture Capital

Venture capital will continue to play a critical role in fostering innovation as technology advances at a breakneck rate. Emerging concepts like decentralized finance, diversity, and sustainability are shaping the future of venture capital, creating new investment opportunities. Venture capital will greatly influence our global economy by supporting innovative ideas and entrepreneurs.

Answers to Common Questions (FAQ)

1.What is the typical venture capital return on investment?

Depending on the stage of investment and the performance of the portfolio firms, the average return on investment for venture capital varies significantly. Historically, top venture capital funds yield annual returns of 20-30%, though results can vary widely.

2. How are IT businesses assessed by venture capitalists?

Venture capitalists assess tech startups based on technology novelty, business model scalability, leadership strength, and market potential. They also take into account things like financial estimates, consumer traction, and competitive positioning.

3. What distinguishes venture capital from other types of finance in particular?

There are various ways in which venture capital varies from other types of finance.

- Risk and Return: Venture capital (VC) focuses on early-stage businesses with substantial growth potential and makes high-risk, high-reward investments.

- Equity ownership: To match their interests with the startup’s success, venture capitalists usually take equity ownership in the businesses they invest in.

- Active Involvement: In addition to cash investment, venture capitalists (VCs) frequently offer networking opportunities, coaching, and strategic advice.

Key Takeaway

An Overview of Venture Capital’s Significance in Tech Innovation

- Venture capital is crucial for fostering tech innovation by providing early-stage enterprises with financial resources, knowledge, and strategic guidance.

- With this help, startups may grow their businesses, create ground-breaking technology, and succeed in the marketplace.