Inflation has everyone seeking methods to save money.

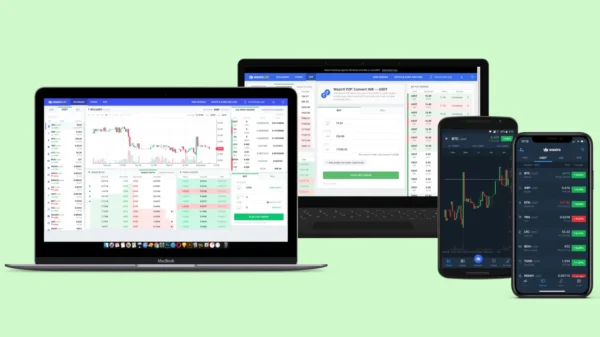

CEO Hussein Fazal says 5 million consumers worldwide have saved over $150 million since Super.com, previously Snapcommerce, launched its reward card SuperCash last October to build credit. It now wants to assist “everyday Americans” save money on travel and shopping with its smart app.

Super.com, along with PayPal, Uber, and DoorDash, is adding functionality to its app, Fazal told TechCrunch. For example, have helps individuals save more. Fazal said his business is building its awesome app after WeChat by entering industries including tourism and finance. Does weChat have a billion users?

“Unlike other super apps, we are trying to have a theme that customers can gravitate toward, and we think savings is that theme,” Fazal added. We’re also releasing now because we’re seeing a high cross-sell rate of consumers buying one product and then another. Not always.”

A new $85 million investment—$60 million in equity and $25 million in a credit facility—is helping the app grow. Fazal claimed the firm now has approximately $200 million.

Inovia Capital led the round with new investors Shopify president Harley Finkelstein, Ancestry.com CEO Deb Liu, Allen Shim, former Slack CFO; Golden State Warriors CFO Josh Proctor; Substack CEO Chris Best; Confluent CTO Neha Narkhede; Mike Lee, co-founder of MyFitnessPal; Hyphen Capital; EDC and Plaza Ventures. Telstra Ventures, Acrew, Lion Capital, and NBA star Steph Curry also invested.

Fazal added that the fundraising climate was different this time, with investors focusing more on top-line growth, and the firm will be a long-term sustainable business.

Fazal stated unit economic trends and the business’s future are emphasized. In addition, investors want to know if this round will fund the company’s independence.

He believes Super.com is headed toward independence. The firm increased double-digits last year and is on course to earn over $1 billion in gross merchandise volume and over $100 million in net sales in 2023.

Fazal said the business was able to “raise at nearly double its valuation” from the 2021 round and close the transaction with favorable conditions in this hard fundraising climate by focusing on top-line revenue and unit economics.

He plans to use the increased financing for product and engineering resources to build new SuperCash and app features. The corporation also researches strategies to save on inflation-driven essentials like petrol and food.

“We have talked to many customers to get data-driven research to build something someone wants,” Fazal added. “Now we’re going to build America’s first savings app so our customers can think of us for every purchase, whether booking travel or buying groceries.”