As the battered memory chip industry shows early signs of recovering from a severe downturn, Samsung Electronics (005930. KS) said Wednesday that its preliminary third-quarter profit declined by a smaller-than-expected 78%.

Analysts predicted that memory chip prices peaked in the third quarter, with certain types already beginning to recover, and that Samsung shares would open 3.3% higher compared to a 1.4% gain in the broader market (.KS11).

In a brief preliminary results announcement, the world’s largest memory chip and smartphone manufacturer projected that its operating profit decreased to 2.4 trillion won ($1.79 billion) in July-September from 10.85 trillion won a year earlier. The result exceeded a 2.1 trillion won LSEG SmartEstimate, which gives greater weight to expert projections that are more reliable overall.

It’s better than I had anticipated. Although the semiconductor industry is not doing well, the reduction in memory costs is slowing down, and additional drops will be few and far between, according to Ko Yeongmin, an analyst at Daol Investment & Securities.

Samsung’s third-quarter earnings were much higher than the first quarter’s 640 billion won, the lowest since 2009, and the second quarter’s 670 billion won, significantly lower than last year.

As memory chip prices fell, the company’s semiconductor division suffered losses of 4.58 trillion won and 4.36 trillion won in the first and second quarters, respectively. The value of its inventory was drastically reduced.

Following a pandemic-driven boom, a worldwide economic recession, and high interest rates slowed consumer demand for most goods, leading chipmakers to reduce output to stop prices from plummeting. However, experts predicted that losses in Samsung’s memory chip division would have decreased to roughly 3 trillion won in the third quarter as the company concentrated on higher-end, more lucrative chips like DRAM used in artificial intelligence while continuing to reduce the production of older legacy chips.

As the severe industrial slowdown that started last year ended, prices of select DRAM chips, which are used in tech gadgets, started to rise at the end of the previous quarter. Meanwhile, according to analysts, prices of NAND Flash chips, which are used in data storage, may start to rise as early as this one.

“When Samsung announces detailed earnings later this month, investors will be tuning in to what it has to say about any changes in prices of legacy chips such as NAND Flash or older DRAM, in order to form outlooks about the chip industry’s more complete recovery,” Ko stated.

On October 31, a thorough earnings report is expected. According to Samsung, its income, which was 67 trillion won during the same period last year, likely decreased by 13%.

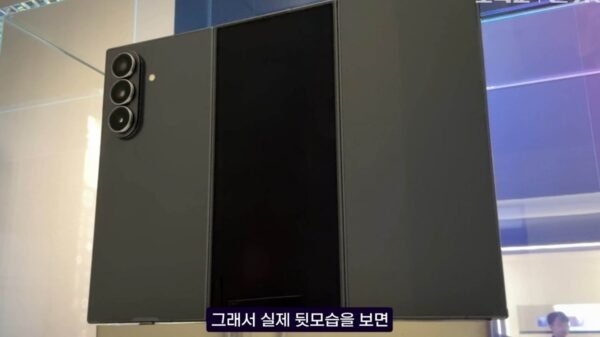

An average of five experts’ predictions indicates that the company’s mobile division most likely earned an operating profit of about 3 trillion won, similar to last year. Despite the weak global smartphone market, the business saw strong sales from the debut of its premium foldable devices throughout the quarter.

Given that the third quarter is when Samsung releases its flagship devices and demand for display panels from customers like Apple (AAPL.O) increases before the release of the newest iPhone, the third quarter is typically robust for Samsung’s mobile and display businesses.